Smart DEX Traders and whales take profits as WLD declines but the $2.40 support shows signs of holding.

AMB Crypto

You can visit the page to read the article.

Source: AMB Crypto

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Bitget Launches Round 6 of Diamond Thursday with 50,000 BGB Airdrop

Victoria, Seychelles, December 20th, 2024, Chainwire Bitget , the leading cryptocurrency exchange, and web3 company is pleased to announce the return of its popular Diamond Thursday event. In its sixth round, the promotion offers participants the chance to share in a pool of 50,000 BGB tokens by meeting specific trading and deposit requirements. The Diamond Thursday event aims to reward active traders and participants within the Bitget ecosystem. Running from 18 December 2024 at 16:00 (UTC) to 25 December 2024 at 15:59 (UTC), the promotion is open to eligible users who register and meet the outlined criteria. How to Participate Participants must meet the following requirements: Deposit Requirement: Make a net deposit of at least 100 USDT in any cryptocurrency. Trading Activities: BTC Trading: Achieve a total spot trading volume of 10,000 USDT or more. BGB Trading: Achieve a total spot trading volume of 10,000 USDT or more. Each qualifying trading activity earns participants one share of the airdrop pool, with rewards distributed as follows: Airdrop Allocation: 50,000 BGB ÷ Total Shares Earned by Participants Additional Details: Registration on the promotion page is required before trading volumes and deposits are considered. Certain trades, such as zero-fee pairs (e.g., BTC/EUR, BTC/USDE), as well as transactions by sub-accounts, institutional users, market makers, and API trading, are excluded from the calculations. Incentives will be distributed within 1–3 working days following the promotion’s conclusion. For more information on Diamond Thursday users can visit here. About Bitget Established in 2018, Bitget is the world`s leading cryptocurrency exchange and Web3 company. Serving over 45 million users in 150+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions, while offering real-time access to Bitcoin price , Ethereum price , and other cryptocurrency prices. Formerly known as BitKeep, Bitget Wallet is a world-class multi-chain crypto wallet that offers an array of comprehensive Web3 solutions and features including wallet functionality, token swap, NFT Marketplace, DApp browser, and more. Bitget is at the forefront of driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World`s Top Football League, LALIGA , in EASTERN, SEA and LATAM market, as well as a global partner of Turkish National athletes Buse Tosun Çavuşoğlu (Wrestling world champion), Samet Gümüş (Boxing gold medalist) and İlkin Aydın (Volleyball national team), to inspire the global community to embrace the future of cryptocurrency. Risk Warning : Digital asset prices may fluctuate and experience price volatility. Only invest what you can afford to lose. The value of your investment may be impacted and it is possible that you may not achieve your financial goals or be able to recover your principal investment. You should always seek independent financial advice and consider your own financial experience and financial standing. Past performance is not a reliable measure of future performance. Bitget shall not be liable for any losses you may incur. Nothing here shall be construed as financial advice. Contact Public Relations Media Bitget media@bitget.com AMB Crypto

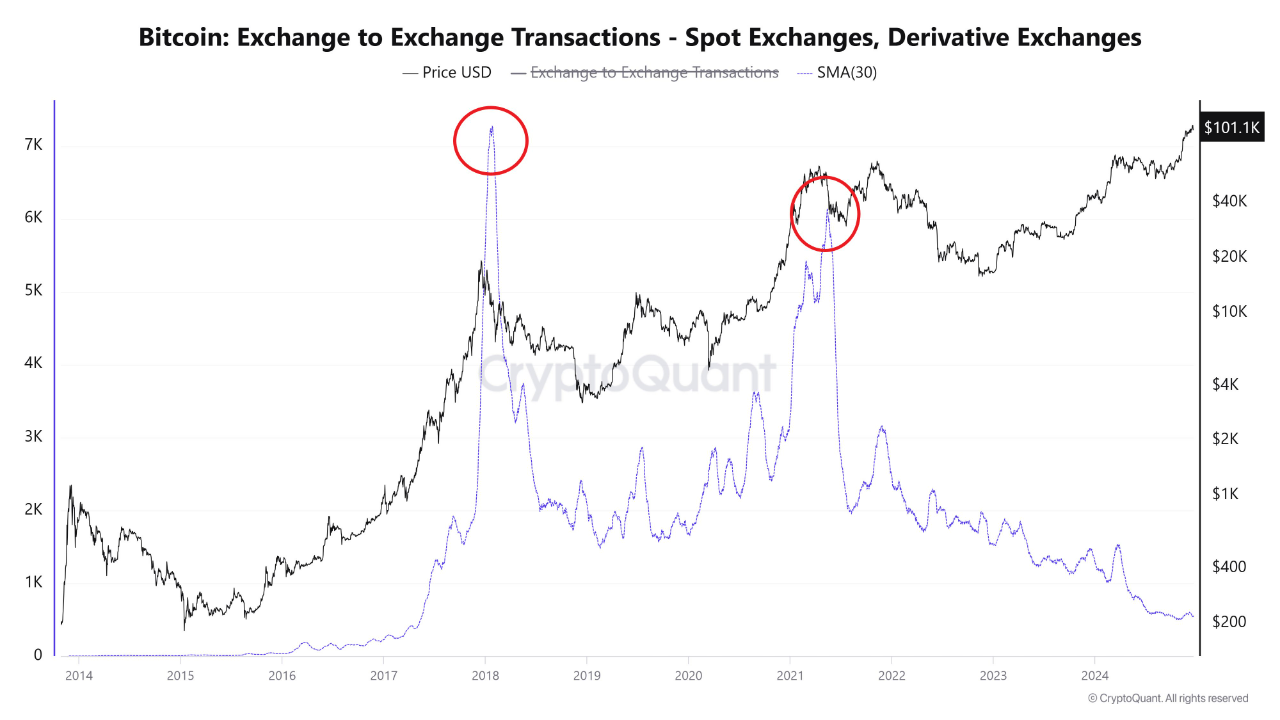

Bitcoin’s Exchange Transactions Hit Record Lows—What This Means For BTC’s Price

Bitcoin has experienced significant price movements in the past few days, largely influenced by macroeconomic developments and market fundamentals. Following the Federal Open Market Committee (FOMC) meeting and a speech by Federal Reserve Chair Jerome Powell, Bitcoin’s price dropped sharply below $99,000. However, the leading crypto quickly rebounded, climbing back to $104,000 earlier today before settling at $100,573 at the time of writing. This represents a 3.4% decrease over the past day and a roughly $67 billion reduction in its market cap valuation. Related Reading: Bitcoin’s Price Momentum Shifts As Spot Market Outpaces Futures – Here’s What It Means Exchange Transactions Hit Record Lows Amid this price performance, CryptoQuant analyst known as Woominkyu provided insights into Bitcoin’s market activity, highlighting declining exchange transaction volumes. According to Woominkyu, historical data suggests a correlation between transaction volume spikes and significant price movements. For example, peaks in exchange transactions coincided with Bitcoin’s dramatic price surges in 2017 and 2021. However, recent data shows a marked decline in transaction volumes on both spot and derivative exchanges, reflecting reduced trading activity compared to previous years. This decrease, according to the CryptoQuant analyst may indicate “waning market participation,” suggesting a “period of consolidation or reduced volatility” in the near term. Bitcoin Key Support Levels and Technical Insights Market intelligence platform IntoTheBlock has shed light on an important support zone forming just below the $100,000 mark. The data shared by the platform reveals that over 1.45 million BTC were accumulated at an average price of $97,500. This accumulation has established a significant demand zone, potentially serving as a “buffer” against further price declines. The importance of this level lies in its ability to provide a foundation for price stability, particularly as Bitcoin navigates its current phase of market correction. It is suggested that a breach below this zone could trigger further downward pressure, while holding above it might boost recovery efforts. Meanwhile, from a technical perspective, insights shared by market analyst Satoshi Wolf highlight the critical nature of Bitcoin’s current price levels. The cryptocurrency recently tested the $100,000 support, aligning with the 100-day Exponential Moving Average (EMA). Related Reading: Is The Crypto Bull Run Over? Top Exec Discusses The Market Crash This level is pivotal as it combines technical indicators with psychological significance. The Moving Average Convergence Divergence (MACD) indicator shows bearish momentum, while the Relative Strength Index (RSI) nears oversold territory, signalling the potential for a price reversal. Wolf suggests that traders monitor for a confirmed breakout above $104,000 or a breakdown below $100,000, with volume confirmation being key to validating either. ???? $BTC Analysis: The chart shows a recent pullback after a strong uptrend, suggesting potential profit-taking. Price is testing the 100,000 support, aligning with the 100 EMA, a crucial level to watch. If it holds, a bounce back towards 104,000 resistance is possible. MACD… pic.twitter.com/smLaqsr2Tz — Satoshi Wolf (@SatoshiWolf) December 18, 2024 Featured image created with DALL-E, Chart from TradingView AMB Crypto