POWELL: Swift Interest Rate Reductions Could Adversely Impact Inflation ————— NFA.

CoinOtag

You can visit the page to read the article.

Source: CoinOtag

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Apollo and Securitize partner to launch tokenized access to credit fund

More on Apollo Global Management AHL.PR.F: A 7.00% Preference Shares IPO From Aspen Insurance Holdings Apollo: The S&P 500 Entry Doesn`t Compensate The New Valuation (Rating Downgrade) Apollo: Great Relative Value Pick Amid Rich Peer Valuations Twelve more firms settle with SEC on recordkeeping failures over messaging apps Key deals this week: FuboTV - Disney, Constellation Energy, Eli Lilly, Phillips 66, Intercontinental Exchange and more CoinOtag

CHAINLINK PRICE ANALYSIS & PREDICTION (January 30) – Link Signals Buy as Crypto Market Recovers Today, Where Next?

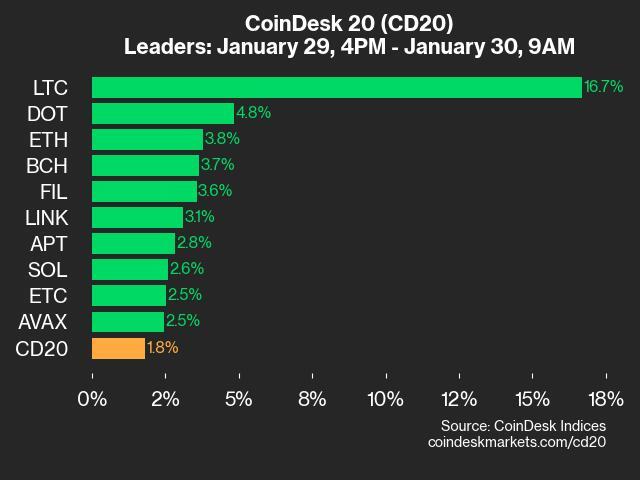

Ending a week retracement two days ago, Link is now footing a bullish move as volume slowly flows back into the market. It is showing signs of increase following a 5% surge since yesterday. This month brought a little setback in the market as Link went through a short retracement phase after reaching a new milestone last month. Though the bulls attempted to resume pressure in the mid-month but they failed to sustain it after testing $27. Multiple rejections from that price level triggered a drop last week and the asset continued to retrace until it tested the $22 level on Monday. It reiterated actions the following day but the bulls intercepted and the bleeding stopped, marking an end in the retracement phase. Yesterday, trading volume increased and the price bounced, closing strong for the first time in a week. Today, the bulls further show commitment and are now aiming to claim more highs as volume slowly rises. A surge above last week’s high could activate another leg up, which could skyrocket the price to a new high. Meanwhile, it is important to note that there’s still room for drops should the bears step back in action. If that happens, Link must dip below the current weekly low before considering an extension. But as it appears now, the bulls are likely to gain control as volume enhances. LINK’s Key Levels To Watch Source: Tradingview Now that the landscape is gradually changing again, Link may retake the previous $27 high along with the $31 level, where it initiated drops last month. Breaking out of this level could rally us to $33 and maybe $40. The latest increase is supported by the weekly $22 low. If the price drops off this low, the market may extend bearishness to $20.7 and even $17.9. The support level below it is $16.1 Key Resistance Levels: $27, $31, $33 Key Support Levels: $20.7, $17.9, $16.1 Spot Price: $24.5 Trend: Bullish Volatility: High Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news ! Image Source: skorzewiak / 123RF // Image Effects by Colorcinch CoinOtag