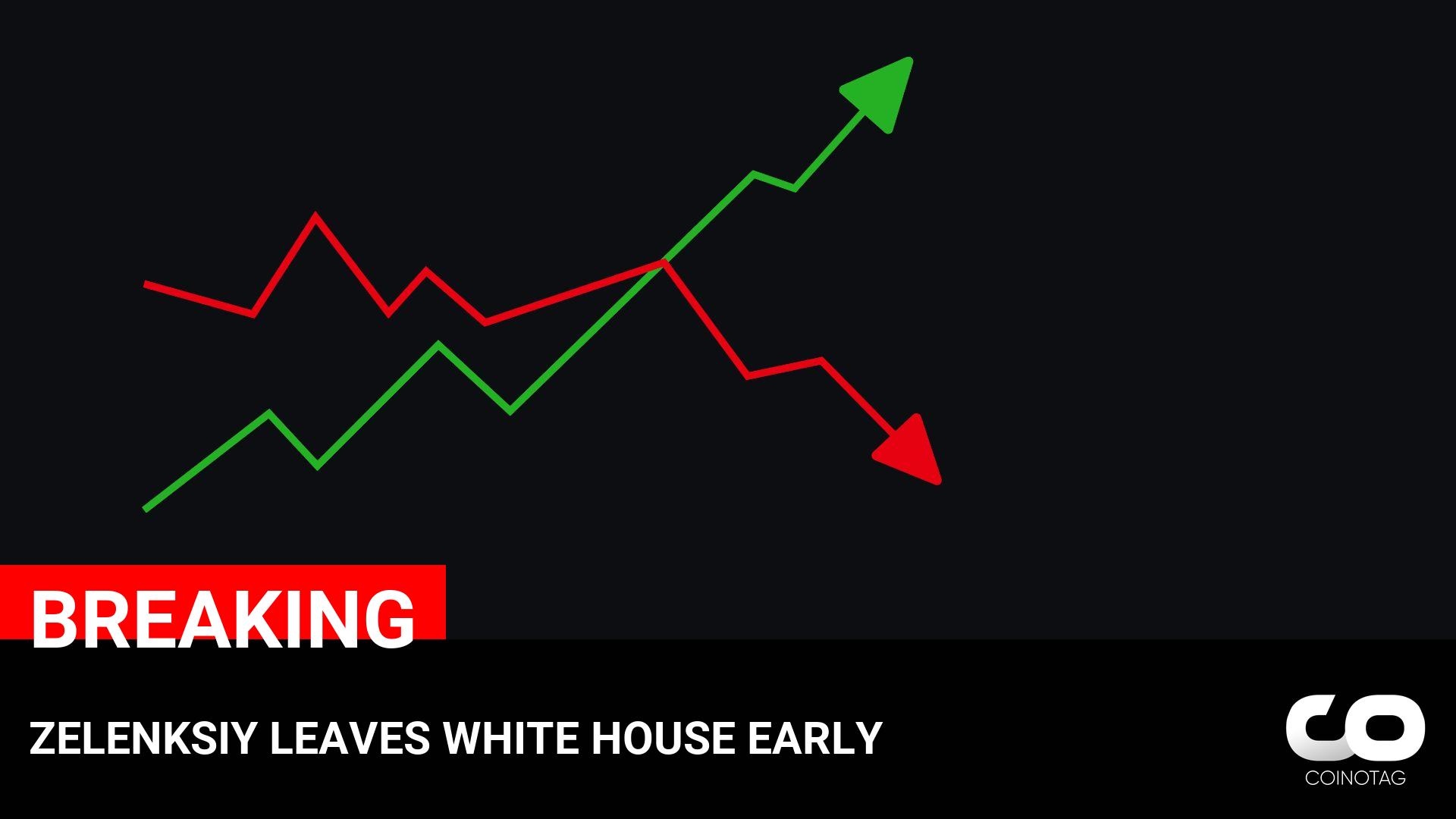

BlackRock was trending heavily on X on Friday, February 28, as Bitcoin ‘s ( BTC ) price plummeted below the $80,000 mark, reaching its lowest level since the start of 2025. As panic spread, speculation arose that BlackRock was offloading its Bitcoin holdings. One particularly viral claim came from Crypto Beast , a well-known account with over 658,000 followers, suggesting that BlackRock had dumped as much as $500 million worth of BTC on February 27. The claim sparked heated discussions, with many questioning whether the world’s largest asset manager was actively contributing to Bitcoin’s decline. ???? BREAKING ???? BLACKROCK JUST SOLD AN EXTRA $500M WORTH OF CRYPTO. THEY ARE SELLING EVERYTHING pic.twitter.com/e5FCdHIDAc — Crypto Beast (@cryptobeastreal) February 27, 2025 Deep dive into the IBIT sales However, a closer look at the data paints a different picture. According to the Arkham analysis, BlackRock’s iShares Bitcoin Trust (IBIT) still holds approximately 577,919 BTC. While the fund did see a net outflow of 2,274 BTC on February 27 and a seven-day outflow of 10,595 BTC, this does not mean BlackRock itself is selling Bitcoin. BlackRock Bitcoin balance. Source: Arkham Intelligence Instead, these figures indicate that investors in the ETF are redeeming their shares, which forces the fund to sell BTC to match the redemptions. This is an important distinction—BlackRock, as the fund issuer, is not choosing to sell BTC, but rather adjusting its holdings in response to investor demand. In reality, BlackRock appears to be increasing its exposure to Bitcoin-related assets rather than selling. A recent Schedule 13G filing revealed that the firm now owns 5% of Strategy (MSTR), equivalent to roughly 11.2 million shares. A 0.91% increase from its previous 4.09% stake as of September 30, 2024. The data contradicts the notion that BlackRock is intentionally dumping Bitcoin. Instead, the outflows from IBIT and other funds are the result of retail and institutional investors selling their ETF shares, not BlackRock itself liquidating its BTC holdings. Larry Fink is not selling Bitcoin, and there is no evidence to support the claim that BlackRock is exiting its BTC position. Panic often fuels speculation during market downturns, this situation highlights the importance of distinguishing between investor-driven ETF redemptions and direct asset sales by BlackRock. Featured image via Shutterstock The post Is BlackRock dumping Bitcoin? appeared first on Finbold .

Finbold

You can visit the page to read the article.

Source: Finbold

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Millions of Dollars To Be Handed Out Per Year – No Strings Attached – As US City Launches New Guaranteed Income Pilot Program

A US city is launching a guaranteed income pilot program that will disperse millions of dollars per year to families living below the poverty line. Billed as the “first-ever cash prescription program” in Kalamazoo, Michigan, the Rx Kids guaranteed income pilot program has allocated $10 million to help pregnant and nursing mothers financially during the early stages of a baby’s life. Selected participants will receive a one-time payment of $1,500 after 16 weeks of pregnancy and $500 every month for the first 12 months of the baby’s life. Enrollment for Kalamazoo’s guaranteed income program kicked off on February 12th. The monthly payments will stop after the baby’s first birthday. “Rx Kids is available to all City of Kalamazoo pregnant people and babies born on or after Feb. 1, 2025. Participants can sign up during pregnancy or until a child is six months of age. Cash prescriptions will start at the point of enrollment. There are no income requirements or strings attached. Families are free to spend their Rx Kids dollars as they see fit.” The Kalamazoo guaranteed income pilot program has raised $10 million so far and the amount is expected to help run the project for two years. The program was started by the Michigan State University Pediatric Public Health Initiative in partnership with Poverty Solutions at the University of Michigan. It is administered by Give Directly, a nonprofit. A similar program by the same organization was launched last year in Flint, a city located northeast of Kalamazoo. Rx Kids director, Mona Hanna, says, “When Rx Kids launched in Flint one year ago, the goal was to prove that we could successfully build an efficient and effective program to not only bolster family financial security and improve maternal and infant health outcomes, but to also share this ready-to-go program with communities across our great state.” Don`t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox Check Price Action Follow us on X , Facebook and Telegram Surf The Daily Hodl Mix Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing. Generated Image: Midjourney The post Millions of Dollars To Be Handed Out Per Year – No Strings Attached – As US City Launches New Guaranteed Income Pilot Program appeared first on The Daily Hodl . Finbold

![Bitcoin (BTC) took the spotlight from the rest of the crypto market in 2024, but the Trump administration is quickly changing the rules of the game and a rotation into other assets could end up happening, according to crypto data firm Kaiko Research In fact, the decentralized finance (DeFi) sector isn’t looking too bad, Kaiko research analysts Adam McCarthy and Dessislava Aubert wrote in a new report. The company’s DeFi index (KSDEFI) has outpaced ether (ETH) since the instrument’s inception in October 2023, bringing in roughly 75% returns in that span of time. That’s remarkable considering that most of the protocols included in the index are built on Ethereum. “This outperformance may persist into the latter half of 2025, as several assets within the index benefit from strong tailwinds,” the report said. “This trend highlights the decreasing correlation between the DeFi index and ETH over time, as the decentralized finance sector continues to expand beyond the Ethereum ecosystem.” The index is composed of 11 DeFi tokens, the most heavily weighted being UNI, AAVE and ONDO. At least four of these tokens have powerful tailwinds for the rest of the year, the report said. For example, regulatory developments in the U.S. may open up possibilities for decentralized exchange Uniswap and decentralized lender Aave to implement fee switches for each of their respective tokens, meaning that protocol fees may end up getting distributed to UNI and AAVE holders. Tokenization protocol Ondo Finance, for its part, will likely benefit from an acceleration of the tokenization trend as Wall Street keeps wading deeper into crypto, the report said. “Regulatory constraints in key markets have been a significant hurdle [since 2020], but they are only part of the challenge. DeFi has also faced structural issues, including high user friction due to fees and security concerns. However, with regulatory scrutiny easing, the sector now has abundant opportunities for growth,” the report said.](/image/67c201d72eda1.jpg)

Why DeFi Projects Could Be Ready to Outperform: Kaiko Research

Bitcoin (BTC) took the spotlight from the rest of the crypto market in 2024, but the Trump administration is quickly changing the rules of the game and a rotation into other assets could end up happening, according to crypto data firm Kaiko Research In fact, the decentralized finance (DeFi) sector isn’t looking too bad, Kaiko research analysts Adam McCarthy and Dessislava Aubert wrote in a new report. The company’s DeFi index (KSDEFI) has outpaced ether (ETH) since the instrument’s inception in October 2023, bringing in roughly 75% returns in that span of time. That’s remarkable considering that most of the protocols included in the index are built on Ethereum. “This outperformance may persist into the latter half of 2025, as several assets within the index benefit from strong tailwinds,” the report said. “This trend highlights the decreasing correlation between the DeFi index and ETH over time, as the decentralized finance sector continues to expand beyond the Ethereum ecosystem.” The index is composed of 11 DeFi tokens, the most heavily weighted being UNI, AAVE and ONDO. At least four of these tokens have powerful tailwinds for the rest of the year, the report said. For example, regulatory developments in the U.S. may open up possibilities for decentralized exchange Uniswap and decentralized lender Aave to implement fee switches for each of their respective tokens, meaning that protocol fees may end up getting distributed to UNI and AAVE holders. Tokenization protocol Ondo Finance, for its part, will likely benefit from an acceleration of the tokenization trend as Wall Street keeps wading deeper into crypto, the report said. “Regulatory constraints in key markets have been a significant hurdle [since 2020], but they are only part of the challenge. DeFi has also faced structural issues, including high user friction due to fees and security concerns. However, with regulatory scrutiny easing, the sector now has abundant opportunities for growth,” the report said. Finbold