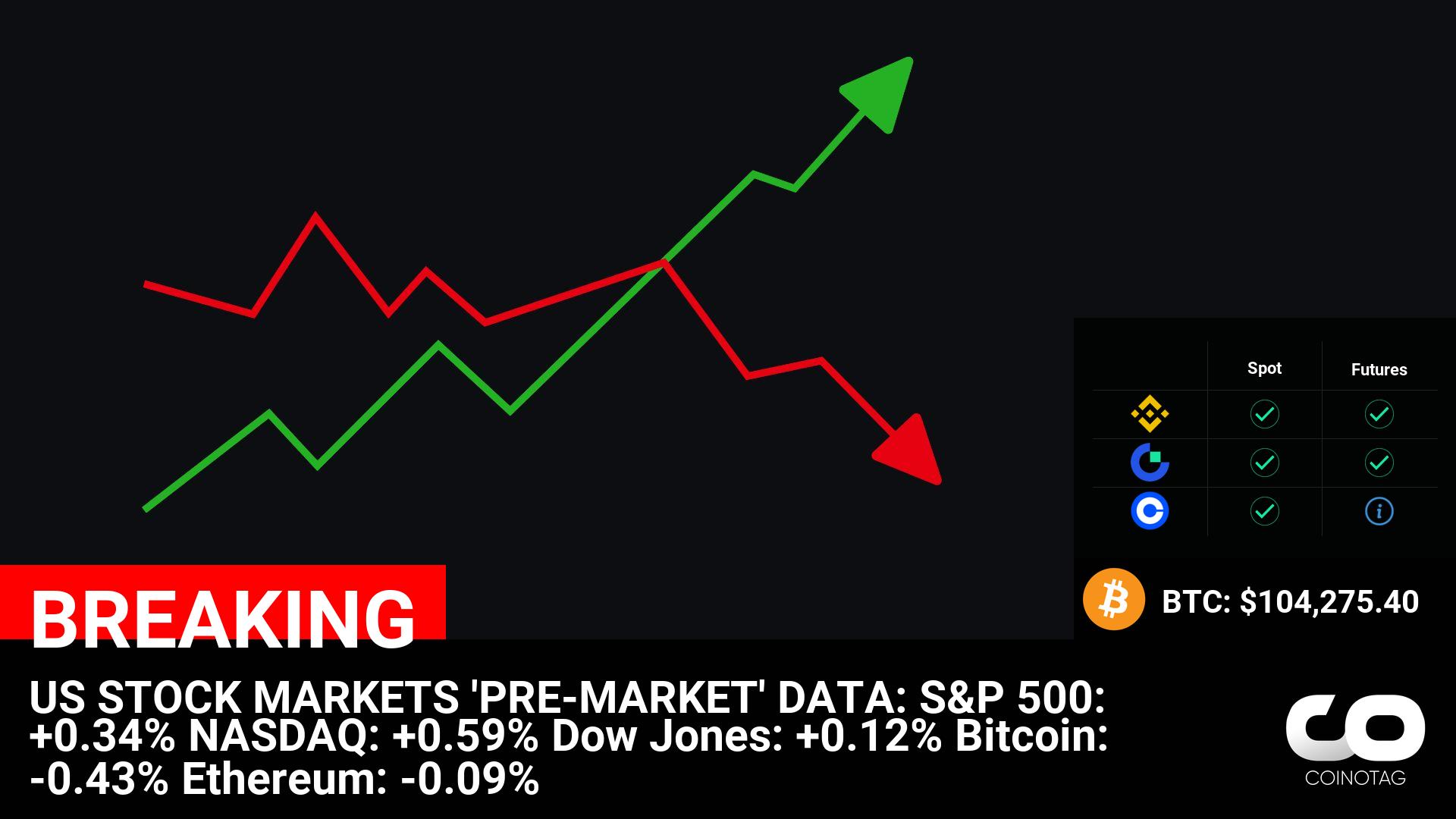

Around 80,000 Bitcoin options contracts will expire on Friday, Jan. 30, and they have a notional value of roughly $8.36 billion. This week’s expiry event is a large one because it is the end of the month. However, crypto derivatives expiry events such as this rarely influence spot markets, which have remained relatively flat this week. Bitcoin Options Expiry This week’s batch of Bitcoin options contracts has a put/call ratio of 0.68, which means that there are more call (long) contracts expiring than puts (shorts). Moreover, open interest (OI), or the value or number of BTC options contracts yet to expire, is highest at the $120,000 strike price, which is $2.4 billion, according to Deribit. There is also around $1.65 billion in OI at the $110,000 strike price, as derivatives traders continue to speculate that BTC prices will rise from current levels. Earlier this week, crypto derivatives provider Greeks Live said the “longer-term outlook remains constructive with expectations of continued upward momentum.” Meanwhile, Deribit reported that Bitcoin’s brief drop below $100,000 this week caused changes in the derivatives market. Short-term traders were buying more put options than usual, but longer-term traders remained optimistic, favoring call options, it stated. Bitcoin OI by expiry. Source: Deribit Around 600,000 Ethereum contracts are also expiring in addition to today’s tranche of Bitcoin options. These have a notional value of $1.95 billion and a put/call ratio of 0.43. This brings Friday’s combined crypto options expiry notional value to around $10.3 billion. Crypto Market Outlook Total market capitalization has fallen just over 1% on the day to $3.68 trillion, where it was at the same time last week. Bitcoin reached $106,000 in an intraday high on Thursday but started to retreat during the Friday morning Asian trading session, falling to $104,300 at the time of writing. It has recovered from a Monday dip into the five-figure territory but failed to gain further momentum this week. Ethereum remains weak, having failed to reach $3,300 and trading at just over $3,200 at the time of writing. The altcoins were generally mixed with minor gains and losses on Friday morning. Stellar (XLM), Sui (SUI), and Litecoin (LTC) were doing a little better than the rest. Analysts have observed that February is usually much better for crypto price action than January, so things could be about to heat up. The post How Will Markets React as $10B in Crypto Options Expire Today? appeared first on CryptoPotato .

Crypto Potato

You can visit the page to read the article.

Source: Crypto Potato

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Gold Price Hits Record High, Surpasses $2,800 per Ounce – What It Means for Cryptocurrencies

GOLD PRICE SURGES TO HISTORIC HIGH EXCEEDING $2,800 PER OUNCE ————— NFA. Crypto Potato

Cardano Completes Plomin Hard Fork, Ushering in Full On-Chain Governance

A significant success has been achieved by Cardano with the Plomin Hard Fork’s execution. This marks the official and seamless transition to full and complete on-chain governance and task execution in the community that controls the blockchain. Cardano’s success with its governance model further reinforces a commitment to decentralization, resilience, and, of course, security. JUST IN: Cardano successfully executed the Plomin Hard Fork, introducing full on-chain governance. https://t.co/BxKz2tZujk — Cardano Hieronymus (@CardanoHumpback) January 29, 2025 The network has been managed by more than 1,100 block-producing pools for several years, ensuring its stability and security. The pools and the broader Cardano community now exercise full on-chain governance over the platform. That means these nearly 1,200 delegators, and the additional 100+ million ADA staked to them, control the platform’s protocol upgrades and the allocation of its $1.5 billion treasury. Cardano will have its Plomin hardfork in about 9 hours. DReps will activate, as a new era of self-governance begins The community, which has controlled the network for years with 1100+ block producing pools, today also assumes full control over protocol and $1.5bn treasury https://t.co/7B14roNRYm — whale (@cardano_whale) January 29, 2025 Empowering ADA Holders with Governance Control This upgrade gives ADA holders many new avenues to partake in Cardano’s governance structure. Delegation and representative voting now make it possible for the community to stay at the helm when it comes to making key decisions about network changes, treasury management, and protocol upgrades. 1. Voting Delegation to Stake Pool Operators – Cardano’s stake pool operators (SPOs), who have long secured the network and maintained it, will now have the power to decide on-chain upgrades and protocol parameter changes. ADA holders can delegate their governance power to these operators and let them make key decisions about the network’s future. 2. Votes are Delegated to dReps (Delegated Representatives) – dReps are registered ADA holders who actively govern Cardano by representing the broader community in decision-making processes. They cast votes on proposals, oversee treasury management, and otherwise ensure the platform moves in a user-beneficial direction. In short: If you’re an ADA holder and don’t want to directly participate in governance, you can delegate your voting to a dRep. He or she will ensure your interests are represented. 3. The process of becoming a dRep – Any holder of ADA can participate in Cardano’s governance structure by registering as a dRep. With merely 500 ADA, one can apply for this position and, if you can believe it, actually campaign to become a “delegate representative.” What a governance structure! Withsuch an incredibly low barrier to entry, governance becomes much more accessible and thesepOS much more open to dissenting views. Cardano’s Plomin Hardfork is ready for launch! Today, at the epoch’s end, Cardano is rolling out groundbreaking upgrades never before seen in the blockchain industry! The highlight? A new stake-based voting system that puts $ADA holders in charge of shaping the future of the… pic.twitter.com/KDXFPinvx2 — AdaLink | Frenchies (@AdaLink_io) January 29, 2025 Moving to complete on-chain governance coincides with the Voltaire era, which focuses on decentralized decision-making and self-sustainability. Voltaire allows the Cardano community to take what could be metaphorically said to be “the wheel.” ADA holders control the governance mechanisms and treasury allocations, so if you are an ADA holder, you control the changes made to the Cardano protocol. Market Reaction: Whales Remain Cautious This momentous occurrence has occurred; however, on-chain data propose that ADA’s large holders have not seen the results in their portfolios break even. These investors appear to have offloaded almost 200 million ADA since Martin Luther King, Jr. week, which might seem alarming at first. Yet, the ADA market hasn’t seen a bloodbath; rather, it has been somewhat stable. “ADA whales” don’t appear to be panickers. Thus, what ADA whales have been doing of late might just be allowing some elbow room for the elusive recovery of ADA back to the $0.30 to $0.33 range that prevailed before the bottom fell out in mid-November 2022. Whales have remained relatively flat after offloading over 180 million #Cardano $ADA between Jan. 19 and Jan. 23! pic.twitter.com/9BbktJvCwe — Ali (@ali_charts) January 29, 2025 This trend presents some intriguing market-sentiment questions. For blockchain networks, decentralization is a central value proposition. But major investors often need to gauge the changes’ economic and structural implications before they feel comfortable investing. If Cardano’s governance ends up being efficient and effective, that could end up attracting way more institutional interest in ADA than there is today. A Defining Moment for Cardano By fully implementing on-chain governance, Cardano demonstrates how decentralized and resilient a blockchain network can be. Why? Because ADA holders can directly affect protocol-level decisions. When they do so, you can be certain that the changes they’ve instantiated are in the best interest of the ADA holder as a user of the network. Voltaire stands as a pivotal point in the Cardano timeline, demonstrating not only the ability to govern a blockchain network but also the means to transform such networks into fully community-driven ecosystems. The more ADA holders we have participating in governance today, the stronger the network becomes at innovating, adapting, and serving as a precedent for other decentralized projects in the space. The market response is still tepid, but this upgrade could have a meaningful long-term impact. Cardano has not just moved to decentralized governance; it has done so in a cogent way, with a model that other platforms might reasonably look to as they also steer toward decentralized, community-based governance. For holders of ADA, this shift is a clear invitation to be more active in the design and management of the network, assuring that it morphs toward what might be considered reasonable and sustainable forms in the future. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news ! Image Source: Photo by Traxer on Unsplash // Image Effects by Colorcinch Crypto Potato