On February 8th, COINOTAG News reported a significant update from Ethereum’s founder, Vitalik Buterin, who highlighted a successful dynamic adjustment of the block Gas limit for Ethereum’s Layer 1 (L1)

CoinOtag

You can visit the page to read the article.

Source: CoinOtag

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Why is Ether Down Today? Market Fears and Growing Supply Help Fuel 5% Slide

Ether (ETH) has fallen more than 5.1% over the past 24-hour period to below $2,600, while bitcoin (BTC) is down around 2.9% over the same period to $95,700. The largest altcoin’s price performance has pushed down the CoinDesk 20 Index by nearly 4% over the period amid a market downturn that also affected equities markets over U.S. President Donald Trump announcing plans to unveil reciprocal tariffs next week, escalating fears of a trade war with the country’s major trading partners. Yet ether’s underperformance comes amid other factors influencing the cryptocurrency specifically, including its circulating supply having recently risen past pre-Merge levels. The Ethereum Merge —the network’s merge with the Beacon Chain that moved it to a Proof-of-Stake (PoS) consensus mechanism—was widely expected to help its supply drop, and it did so for months. The trend, however, reversed in April, weeks after the activation of the highly anticipated “Dencun” upgrade . This upgrade suppressed the growth of layer-2 networks by reducing their data fees and introduced transaction “blobs,” which helped reduce transaction fees. Reducing transaction fees on Ethereum has meant that less ether is burned, which in turn reversed the cryptocurrency’s supply trend. Since the introduction of EIP-1559 in 2021, every ether transaction has a base fee that gets burned, helping reduce the supply of ETH. The reduction in burned ether has seen ETH’s supply grow over the last few months to the point its circulating supply has grown by 8,242 ETH since the Merge, data from Ultrasound.money shows. Ether also saw the Securities and Exchange Commission (SEC) recently delay its decision on listing options contracts for BlackRock’s iShares Ethereum Trust (ETHA), which could also be weighing on the cryptocurrency’s performance. Other factors, including a restriction of the Ethereum Foundation and heightened competition from other networks, including Solana, have also been affecting ether, whose value relative to BTC recently dropped to 2021 lows. In a research report, JPMorgan has said ETH lacks a compelling narrative like that of BTC Despite the bearish performance, analysts have pointed out ether’s price is mirroring a pattern it saw before that was followed by renewed bullish momentum. On Friday, Jake Ostrovskis, an OTC trader at crypto market maker Wintermute, told CoinDesk he was seeing “strong over-the-counter demand for ETH.” Analysts at Santiment pointed out on social media there has been a drop in the amount of ETH tokens at a profit since they were first mined as bearish sentiment affects the cryptocurrency, which could be a potential setup for a surprise bounce “once crypto markets are able to stabilize.” CoinOtag

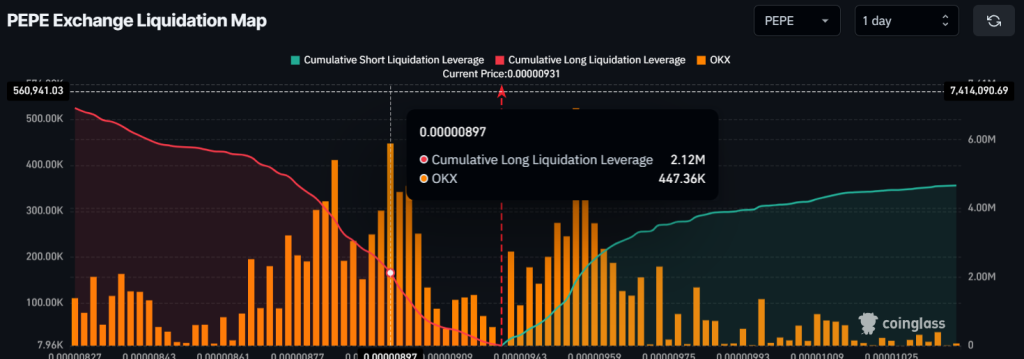

Wall Street Pepe Rockets Past $70M in Biggest Crypto Presale of 2025

Wall Street Pepe (WEPE) isn’t just trending – it’s exploding. The project has now passed $70 million in its presale, leaving many wondering if this new meme coin is about to shake up the market. With the presale ending in just over a week, can Wall Street Pepe’s momentum translate into real-world success? Inside Wall CoinOtag