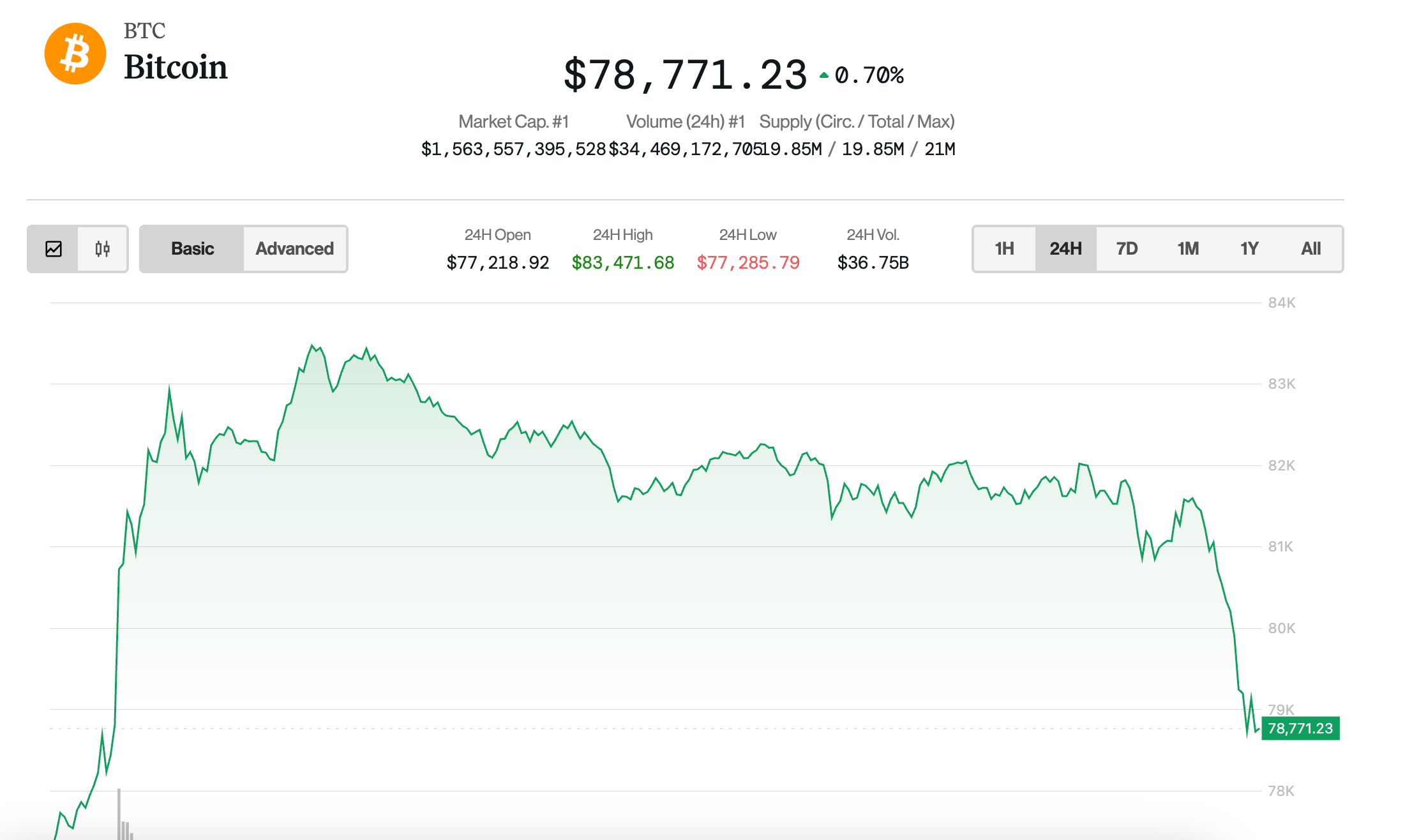

The previous 30 days have recorded significant ups and downs across the cryptocurrency market, with various assets demonstrating sharp changes in the percentage of their supply that is currently in profit. Among the strongest performers, $TON (Toncoin) and $BNB (Binance Coin) are showing notable gains, while $DOGE (Dogecoin), $XRP (Ripple), and $SOL (Solana) are experiencing sharp declines in the percentage of their supply that is in profit. This dynamic shift highlights the volatile nature of the crypto market—one where different assets can experience contrasting fortunes over short periods. TON and BNB Surge as Holders Enjoy Unrealized Gains In the last month, Toncoin ($TON) and Binance Coin ($BNB) have been the top performers by a considerable margin, both appearing in the list of cryptocurrencies with the largest increase in the portion of their circulating supply that is in profit. Since its launch, Toncoin has been steadily gaining strength and momentum. Its supply sitting in profit, however, recently surged—and it’s not surprising to see. Almost 94 percent of Toncoin holders are sitting on unrealized gains, and as I warned at the beginning of this series, that’s a strong signal for any asset—be it pre- or post-IPO, token or coin—that the market has confidence in it. Why did Toncoin see such a large jump in the share of its supply sitting in profit? Here’s one reason. Binance Coin has experienced a 17.4 percentage point increase, and this is now 86.3% of its supply making a profit. Binance Coin is the cryptocurrency that drives the Binance ecosystem. And if Binance continues to grow, there isn’t any reason that the profit percentage of BNB and the utility within the Binance ecosystem shouldn’t continue to grow as well. Over the past 30 days, $TON and $BNB saw the strongest gains in percent supply in profit: TON: +23.8pp → 94.1% BNB: +17.4pp → 86.3% This indicates a significant rise in holders sitting on unrealized gains. pic.twitter.com/5YfaEGo8Jk — glassnode (@glassnode) April 2, 2025 The data reveals that for holders of these coins, there are significant unrealized gains, indicating that a large segment of the market expresses an optimistic view of the future prospects for these assets. Toncoin and Binance Coin persist in their status as two of the more prominent assets in the cryptocurrency space. The data also shows that their profit percentages are increasing, suggesting that they are both still in a growth phase and that trend seems likely to continue for the time being. DOGE, XRP, and SOL See Declines in Profitability On the flip side, the past month has not been kind to some major market players. Dogecoin ($DOGE), once a darling of the meme-coin movement, found itself experiencing a sharp decline in the proportion of its circulating supply in profit—9.7 percentage points down to 53.6%. This means that a large portion of $DOGE holders are now underwater on their investments. And this, of course, brings us a step closer to a world in which Dogecoin exists as a non-viable financial product. Dogecoin’s status as a meme coin and its reliance on social media to drive pricing have contributed to its swingy nature, which has made it vulnerable to the kinds of market sentiment shifts that a national cryptocurrency ban can cause. XRP, likewise, has encountered difficulties, the percent of its supply that is in profit dropping by 5.2 percentage points to 81.5%. XRP has had a tough year because its ongoing legal fight with the U.S. Securities and Exchange Commission (SEC) has kept it very much in the public eye and, some might argue, sent it to the shaming wall, a kind of SEC-sponsored Cirque du Soleil. And that has rippled through XRP’s price and performance, taking it down a notch in what was already a fairly beleaguered patch. Because of the strong loyalty of its user base, standing by XRP through thick and thin, you might have felt sorry for XRP this year. SOL, previously a leading contender in smart contracts and decentralized applications, saw a decline in the share of its supply in profit that dropped 4.4 percentage points to 35.2% of its circulating supply in profit. The decline in Solana’s profitability mirrors the challenges the project is facing as it copes with network outages and scalability issues. Amidst a still-volatile price, it has proven difficult for investors to realize any semblance of profitability on an ongoing basis. Bitcoin and Ethereum Show Stability, But Divergence is Emerging Of the two largest cryptocurrencies by market capitalization, Bitcoin ($BTC) and Ethereum ($ETH), there has been relative stability when it comes to the percentage of supply in profit. Bitcoin saw a modest increase of 1.6 percentage points, bringing the share of holders in profit to 79.5%. This illustrates that Bitcoin has retained its status as the market leader and store of value while reflecting price movements that are more often than not dictated by a wider array of macroeconomic factors, including inflation concerns and institutional adoption. Yet, Ethereum’s performance tells a slightly different story. The percentage of Ethereum’s supply in profit has decreased by 2.3 percentage points, now sitting at 51.7%. Ethereum’s price has faced headwinds due to ongoing scalability concerns and competition from other smart contract platforms. Despite the success of Ethereum 2.0 and the continued growth of decentralized finance (DeFi) and non-fungible tokens (NFTs), Ethereum’s market sentiment appears to be a bit weaker than Bitcoin’s, which could be concerns over the network’s ability to scale and handle increasing demand. Conclusion: A Market in Flux The last 30 days have brought substantial divergence in the cryptocurrency market, where some assets have posted eye-catching profit percentages, and others have seen sharp declines. Toncoin and Binance Coin have been the clearest winners, with the vast majority of their supply now in profit. They stand out in a market otherwise characterized by pronounced losses. On the opposite end of the profit spectrum are Dogecoin, XRP, and Solana, whose assets have shrunk in profitability. They are now accompanied by a number of other assets pulling back, reflecting a cooling investor sentiment. Bitcoin and Ethereum still are, for the most part, playing a very stable game at the moment, with the two leading cryptocurrencies continuing to be relatively stable. But what’s happening with Ethereum is that its supply in profit has been falling, which is showing a clear divergence between it and Bitcoin. And… you guessed it! The still-nascent world of crypto remains dynamic. If you want to steer through the cryptocurrency world, it is essential to grasp these changes in market dynamics and the underlying reasons driving each asset’s performance. What is even more interesting is to speculate about the future: whether the current state of the crypto market, in terms of its graphic representation on trading charts, will yield the same winners and losers as in the past or whether some assets will defy expectations and rise or fall in ways not currently anticipated. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news !

NullTx

You can visit the page to read the article.

Source: NullTx

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

OKX partners with Standard Chartered for crypto collateral mirroring program

OKX is partnering with Standard Chartered to enable institutional clients to use crypto as collateral in a regulated way. OKX (OKB) is boosting its offering for institutional clients. On Thursday, April 10, a crypto exchange partnered with Standard Chartered , with backing from Brevan Howard and Franklin Templeton, to launch a collateral mirroring program. This program will enable institutional clients to keep their collateral with Standard Chartered, instead of with OKX. The exchange will then “mirror” this collateral into their accounts, without ever taking custody of the funds. You might also like: OKX: A Crypto-to-Crypto and Fiat Exchange The program launched as a pilot, complying with Dubai’s Virtual Asset Regulatory Authority (known as VARA) regulations. Standard Chartered will serve as a custodian under that framework, supervised by Dubai’s financial regulators. “Standard Chartered acts as the independent, regulated custodian in the Dubai International Financial Centre (DIFC), regulated by the Dubai Financial Services Authority, ensuring the safe storage of the assets used as collateral,” OKX Why OKX offers Standard Chartered custody There is growing demand among institutions for crypto trading. For instance, CME Group reported a 73% increase in the daily average volume of its crypto futures market. However, these institutional clients don’t trust crypto exchanges with custody of their funds. For instance, exchanges run a risk of hacking and bankruptcy, like in the case of FTX . This, in turn, exposes institutional clients to counterparty risk, potentially leading to billions in losses. You might also like: OKX developer spills details about OKX Wallet app ‘too early’ At the same time, regulations for crypto exchanges are typically less stringent than those for banks or other financial institutions. For this reason, collateral mirroring enables institutions to safeguard their funds with a trusted party. What’s more, Standard Chartered is a Globally Systemically Important Bank, meaning it falls under some of the strictest regulations in financial markets. User funds are segregated from the bank’s balance sheet, ensuring they are protected even if Standard Chartered encounters financial difficulty. Read more: OKX hit with $1.2m fine from Maltese authorities for breaching AML rules: report NullTx

![NEW YORK, NY — A recent U.S. Department of Justice staff memo dismantling the DOJ’s crypto unit and narrowing the scope of its crypto-related enforcement priorities will have no impact on the prosecution of Terraform Labs co-founder and former CEO Do Kwon, prosecutors said Thursday. The memo, sent Monday evening by U.S. Deputy Attorney General Todd Blanche, informed staff that the DOJ would no longer be pursuing prosecution against crypto exchanges, mixing services, or offline wallets for the acts of their end users. Blanche told staff not to criminally charge any violations of federal securities or commodities laws, except under specific circumstances, in cases where the charges would “require the [DOJ] to litigate whether a digital asset is a ‘security’ or a ‘commodity’” and there is an adequate alternative criminal charge. During a hearing on Thursday, U.S. District Court Judge Paul Engelmayer of the Southern District of New York (SDNY) asked prosecutors whether Blanche’s memo would have any impact on the charges against Kwon, which include two counts of commodities fraud and two counts of securities fraud, as well as five other charges including wire fraud and conspiracy to defraud. The prosecution told Engelmayer that they have “no plans” to change their charges against Kwon at this time. David Patton, Kwon’s lead attorney and a partner at Hecker Fink LLP, told Engelmayer that the contents of Blanche’s memo could — at least indirectly — lead to some pre-trial motions from the defense. “I do think it could potentially be the subject of some pre-trial motions,” Patton said. “It may or may not be directly related to the memo.” Patton specified that the questions of whether the cryptocurrencies involved in the case were securities or not could be relevant. In a separate civil case brought by the U.S. Securities and Exchange Commission (SEC) against Kwon and Terraform Labs last year, in which Kwon and his company were found to be liable for fraud , another SDNY judge found that the tokens involved in the case were, in fact, securities. During Thursday’s hearing, Engelmayer told both the prosecution and the defense to inform him well in advance of the trial if they planned to request that he adhere to any of the rulings or findings made by the court in the SEC case. The next batch of pre-trial motions are expected to hit the docket in July, and a third status conference has been scheduled for June 12 at 11 a.m. in New York. Due to scheduling challenges, the start date for Kwon’s criminal trial has been pushed back three weeks from January 26, 2026 to February 17, 2026. Read more: Do Kwon’s Criminal Trial Set for 2026 as Lawyers Deal With ‘Massive’ Trove of Evidence](/image/67f7fb6c84b71.jpg)

DOJ Crypto Enforcement Memo Has No Bearing on Do Kwon’s Criminal Case, Prosecutors Say

NEW YORK, NY — A recent U.S. Department of Justice staff memo dismantling the DOJ’s crypto unit and narrowing the scope of its crypto-related enforcement priorities will have no impact on the prosecution of Terraform Labs co-founder and former CEO Do Kwon, prosecutors said Thursday. The memo, sent Monday evening by U.S. Deputy Attorney General Todd Blanche, informed staff that the DOJ would no longer be pursuing prosecution against crypto exchanges, mixing services, or offline wallets for the acts of their end users. Blanche told staff not to criminally charge any violations of federal securities or commodities laws, except under specific circumstances, in cases where the charges would “require the [DOJ] to litigate whether a digital asset is a ‘security’ or a ‘commodity’” and there is an adequate alternative criminal charge. During a hearing on Thursday, U.S. District Court Judge Paul Engelmayer of the Southern District of New York (SDNY) asked prosecutors whether Blanche’s memo would have any impact on the charges against Kwon, which include two counts of commodities fraud and two counts of securities fraud, as well as five other charges including wire fraud and conspiracy to defraud. The prosecution told Engelmayer that they have “no plans” to change their charges against Kwon at this time. David Patton, Kwon’s lead attorney and a partner at Hecker Fink LLP, told Engelmayer that the contents of Blanche’s memo could — at least indirectly — lead to some pre-trial motions from the defense. “I do think it could potentially be the subject of some pre-trial motions,” Patton said. “It may or may not be directly related to the memo.” Patton specified that the questions of whether the cryptocurrencies involved in the case were securities or not could be relevant. In a separate civil case brought by the U.S. Securities and Exchange Commission (SEC) against Kwon and Terraform Labs last year, in which Kwon and his company were found to be liable for fraud , another SDNY judge found that the tokens involved in the case were, in fact, securities. During Thursday’s hearing, Engelmayer told both the prosecution and the defense to inform him well in advance of the trial if they planned to request that he adhere to any of the rulings or findings made by the court in the SEC case. The next batch of pre-trial motions are expected to hit the docket in July, and a third status conference has been scheduled for June 12 at 11 a.m. in New York. Due to scheduling challenges, the start date for Kwon’s criminal trial has been pushed back three weeks from January 26, 2026 to February 17, 2026. Read more: Do Kwon’s Criminal Trial Set for 2026 as Lawyers Deal With ‘Massive’ Trove of Evidence NullTx