One of the most crucial infrastructure projects in crypto, Chainlink , is now at the center of a new kind of on-chain pattern that is developing. This past week, blockchain analysts noted that a fresh wave of accumulation by unknown actors appears to be anything but random. Some 15 freshly created wallets—new to on-chain activity and previously inactive—have pulled 2.52 million $LINK tokens from Binance in the past week. At current prices, that represents a not-so-quiet transfer of $36.43 million off one of the world’s largest crypto exchanges. This is not your standard whale shuffle or portfolio rebalance. These wallets had formed no previous transactions and seem to have been made just to buy and then take out $LINK. The observers in the crypto world kind of watch this behavior and expect a major catalyst or an insider-led move to follow. Accumulation Patterns Hint at High Conviction When seasoned investors or institutions gather assets, they usually do so in a way that attracts as little notice as possible—by typically setting up fresh wallets, for instance, and using them to distribute holdings across several days, different exchanges, and, if need be, different types of transaction. The 15 wallets we’re looking at here do just that—and do it very well. They took a substantial amount of $LINK from Binance, but not in a way that sent up any price signals. If the price didn’t move, though, how did they manage to take a big chunk of $LINK out of a big exchange? Is Something Huge Brewing in $LINK ? 15 Fresh Wallets Say Yes — But DYOR In just the past week, we’ve tracked something unusual — 15 fresh wallets have been accumulating $LINK from Binance, withdrawing a total of 2.52 million $LINK (~$36.43 million). pic.twitter.com/ZRKT0Ldstq — EyeOnChain (@EyeOnChain) April 24, 2025 Methodical accumulation of this sort usually indicates something beyond just a bull market mood. It reveals what is often a strong conviction, possibly by insiders, early backers, or institutional investors, about the imminent potential of an event (or a series of events) they’re expecting to happen soon. Or it reveals a strong belief in the long-term worth of Chainlink’s technology. You don’t see this kind of accumulation happening by chance. In the past, this kind of wallet activity has come just before big announcements, partnerships, or upgrades in the crypto world. Now, we can only speculate, but thinking about on-chain whispers as something that’s almost always been associated with major Chainlink activity, it seems that we’re on the verge of something kind of significant. Why Chainlink? Why Now? Chainlink has been considered for a long time to be such a foundational layer in the blockchain space that it now seems to truly embody the concept of a blockchain primitive. That is not to say that Chainlink has no competition. It does, notably from the decentralized oracle network Numerai and private company Band Protocol. But Chainlink now seems to be the go-to oracle solution for many teams wanting to connect their smart contracts to off-chain (or real-world) data. What makes the ongoing accumulation wave all the more interesting is the general context enveloping the Chainlink ecosystem. This recent accumulation has, in fact, been happening in a far wider context that should not be overlooked. In recent months, Chainlink has itself been very active within the crypto space. It has been associated with the development of what is called the Cross-Chain Interoperability Protocol (CCIP), which aims to connect disparate blockchains in a way that really does power a unified Web3 ecosystem. At the same time, enterprises and other institutions have been investigating the whole idea of real-world asset tokenization. They’re trying to figure out how they can use smart contracts and other tools in the crypto space to do that in a way that’s somehow better than what they’ve done before. And Chainlink, by virtue of its position, is very well placed to play a big role in all of that. Also, discussions about Chainlink staking updates and greater integration with enterprise blockchains have analysts buzzing. If a big announcement or product rollout is just around the corner, it would explain why such well-heeled entities are seeming to position themselves in advance. Reading the On-Chain Signals One of the clearest forms of market intelligence to come out of crypto is the on-chain data itself. In stark contrast to traditional finance, where one has to hunt for telltale signs buried in quarterly reports or sometimes-even-forensic approaches to piecing together the live drama of economic agents, cryptocurrencies are a realm of constant, loud, and gloriously public movement. That makes it something of a spectator sport for anyone who wishes to understand the real-time pay-for-play antics of the market participants. Moving $36 million in $LINK to new wallets doesn’t promise price action or a bullish catalyst. But it does hint that some big players are making moves based on private knowledge or strong belief that’s not yet reflected in the public market. And what are these alleged actors up to? Could be anything from a protocol upgrade to a new partnership, or even a crypto-wide bull shift. Accumulating $LINK in such a manner is the type of signal that experienced traders pay close attention to. Conclusion: A Storm Brewing? Linking chains has always been of utmost importance for the Web3 infrastructure. The recent actions on the chain could be a delicate prelude for the next major movement of Chainlink. With 15 wallets freshly in Tow, 2.5 million Link tokens have been purposefully and significantly amassed far away from Binance. Though the precise motive is still murky, Chainlink has once again captured investor interest. What could this mean? It could mean that a major rally is in the works. It could mean that there is some significant strategic shift going on with the company. Or it could even mean that some early market players are just positioning themselves ahead of making Link more mainstream. In any case, we’re watching too, because in the world of crypto, quiet wallet movements often speak louder than tweets. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news !

NullTx

You can visit the page to read the article.

Source: NullTx

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

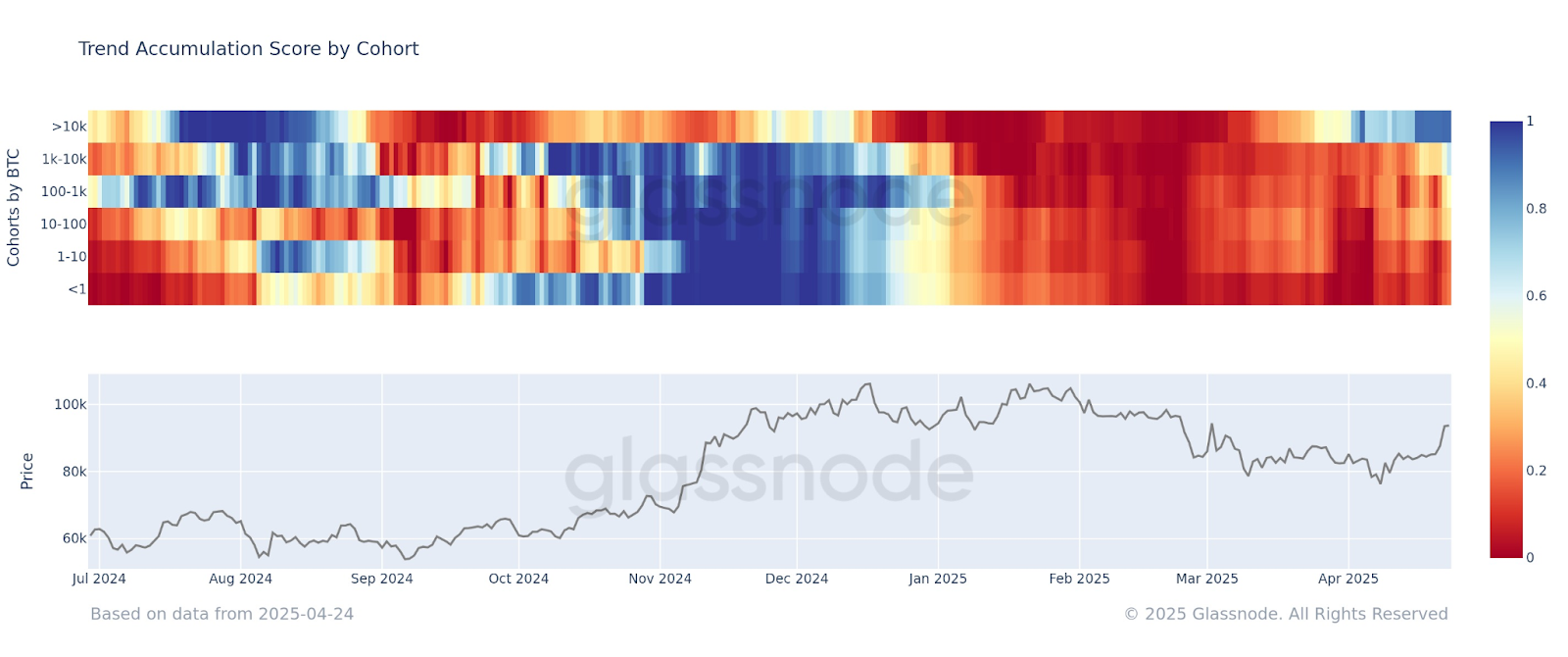

Bitcoin Whale Profits $4.7M from 50 BTC Mined 15 Years Ago

The post Bitcoin Whale Profits $4.7M from 50 BTC Mined 15 Years Ago appeared first on Coinpedia Fintech News A Bitcoin whale just woke up, moving 50 BTC mined over 15 years ago, now worth nearly $4.7 million, showcasing the incredible 93 million percent profit. Meanwhile, whales are piling into Bitcoin again, signaling strong market confidence and pushing prices to new highs. Bitcoin Whales Break 15-Year Silence with $5M Transaction A long-dormant Bitcoin whale woke up, drawing attention from across the crypto space. According to The Bitcoin Historian , a wallet holding 50 BTC mined 15 years ago has moved its funds. These coins, originally mined in 2010 when the price of 1 BTC was below $0.10, have now profited by an astonishing 93,460,500% . Overall, the value of 50 BTC was less than $5. Today, with Bitcoin trading above $94,000, the same holdings are now worth nearly $4.7 million . A similar case unfolded in November 2024, a BTC holder earned a massive profit of 150 million percent, when he sold his 2,000 BTC holdings, originally worth just $120, for approximately $179 million. Are Whales buying Bitcoin Right Now? Bitcoin`s value has jumped +11.2%, and this has once again coincided with key whales & sharks adding on to their already enormous bags. Wallets holding 10-10K $BTC have added 19,255 more coins in this short stretch, and continue to be one of crypto`s most powerful indicators. pic.twitter.com/b3TiVd71iD — Santiment (@santimentfeed) April 25, 2025 According to Santiment data , Bitcoin whales (wallets holding between 10 to 10,000 BTC) have added 19,255 BTC in just one week. This brings their total holdings to an all-time high of 13.47 million BTC. At the same time, Bitcoin’s price jumped by 11.2%, reaching $94,430.89. This pattern shows that when these large investors buy more BTC, it often leads to a rise in price. Their buying reduces the supply available in the market, which can push prices higher. Glassnode’s latest data shows that large Bitcoin holders are buying more during the recent price rise. Wallets with over 10,000 BTC are in heavy buying mode, while those holding 1,000 to 10,000 BTC are not far behind. Even mid-sized wallets with 100 to 1,000 BTC are starting to increase their holdings. This overall buying trend suggests strong confidence in the market and expectations of further growth. NullTx

Ammous Suggests Strategy and BlackRock’s Bitcoin Holdings May Not Threaten Protocol Stability

In a recent discussion, Saifedean Ammous, author of ‘The Bitcoin Standard’, alleviated concerns regarding Bitcoin hoarding and its implications for market stability. Ammous emphasized that major institutional players like BlackRock NullTx