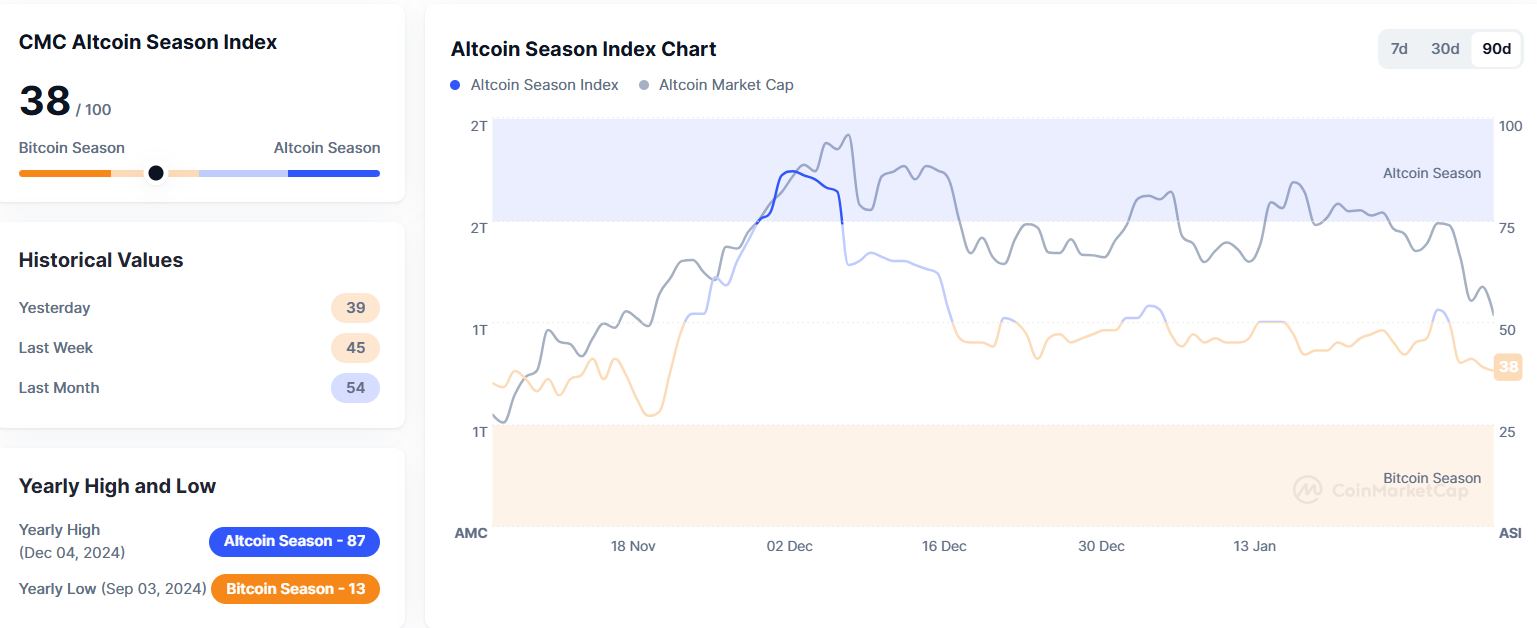

Bitcoin (BTC) fell below $98,000 during the current session as it struggles to recover from Tuesday’s drop of 3.54%. BTC’s drop coincided with a conference by White House Crypto Czar David Sacks that left many in the crypto space disappointed after the flagship cryptocurrency was mentioned only in passing. Sacks said the government will evaluate the feasibility of a Bitcoin reserve. The promise to establish a strategic reserve was one of the key drivers of BTC’s surge past $100,000. Bitcoin (BTC) Dominance At 4-Year High Data from CoinMarketCap has revealed that Bitcoin dominance is at a four-year high, rising past 60% despite ongoing price volatility. The jump in dominance hints at a shift in market dynamic, with capital inflows being directed towards BTC at the expense of altcoins, suggesting investor confidence in the asset remains high. The high dominance rate could push BTC into a long-term bullish cycle, potentially allowing altcoins to rebound. However, analysts believe the market needs fresh liquidity for an altcoin rally. David Sacks Disappoints Bitcoin (BTC) extended its losses following David Sacks`s press conference. The flagship cryptocurrency lost momentum after Monday’s decline and recovery. BTC’s decline coincided with a press conference held by White House Crypto and AI czar David Sacks, along with key heads of committees in the Senate and House. The crypto community was hopeful the press conference would discuss a strategic Bitcoin reserve. However, the press conference focused on regulatory matters. Bitcoin was mentioned in passing at the end of the press conference when Sacks stated the White House is looking into the feasibility of a strategic Bitcoin reserve. Sacks deferred questions about the executive order to create a sovereign wealth fund and if it had anything for Bitcoin. Key Developments Could Signal Bearish Turn Bitcoin (BTC) could lose the $90,000 and $100,000 range thanks to several factors, including a drying up of liquidity and the sluggishness about the creation of a strategic Bitcoin reserve. According to Arthur Hayes, Chief Investment Officer at Maelstrom, dollar liquidity is tightening due to several factors. Hayes pointed out the USD cash balance held in the Treasury General Account (TGA) increased from $623 billion to $800 billion in four weeks. The US hit its self-imposed debt ceiling of $36 trillion last month, and markets were hopeful the Treasury would run down the TGA to keep the government functioning, enhancing market liquidity. Andy Lian, an intergovernmental blockchain expert, stated, “We`re looking at a scenario where key liquidity sources are drying up or being more tightly controlled. This could lead to a slowdown in economic activity, higher borrowing costs, and potentially a more challenging environment for risk assets, including crypto.” Additionally, the Trump administration’s perceived sluggishness regarding a strategic Bitcoin reserve has also dampened sentiment. Talk of a strategic Bitcoin reserve was a key catalyst that propelled BTC past $100,000. However, the Trump administration is being cautious, opting to evaluate the feasibility of such a reserve in a disappointing development for the crypto community that hoped for some action on the proposal. Jim Bianco, President and Macro Strategist at Bianco Research LLC, stated, “Wait, Trump said he would do a $BTC Reserve, not promise to `evaluate it.` Evaluate/Study is what Washington does when they don`t want to do something.” Bitcoin (BTC) Price Analysis Bitcoin (BTC) is hovering around the $98,000-$98,500 levels as it struggles to shed bearish sentiment and build momentum after Monday’s dramatic collapse. BTC’s sluggishness comes as concerns of a trade war between the US and China escalated after the US imposed tariffs on Chinese goods, and China retaliated by taking countermeasures. The developments dampened investor sentiment. The sentiment was further impacted after a press conference by White House Crypto Czar David Sacks, who mentioned Bitcoin and a strategic reserve only in passing. BTC has faced significant volatility over the past few sessions, dipping below the 20-day SMA last Monday and dropping to an intraday low of $97,776 before recovering and settling at $102,064. Sellers retained control on Tuesday as BTC fell to $101,362. Buyers returned to the market on Wednesday as BTC registered an increase of 2.27% and moved to $103,663. Thursday saw BTC rally to an intraday high of $106,296 before settling at $104,553. However, bearish sentiment returned on Friday as BTC fell nearly 2% and settled at $102,616. Source: TradingView BTC went below the 20-day SMA on Saturday as bearish sentiment persisted, dropping 1.54% to $101,041. Negative sentiment intensified on Sunday as BTC fell below $100,000 and the 50-day SMA, dropping over 3% and settling at $97,881. Markets collapsed on Monday thanks to the uncertainty and nervousness created by Donald Trump’s tariffs. As a result, BTC plunged to an intraday low of $91,274. However, BTC rallied from this level, surging to reclaim $100,000 and settle at $101,579, an increase of nearly 4%. However, this rally proved short-lived as BTC dropped 3.54% on Tuesday, slipping below $100,000 and the 50-day SMA and settling at $97,979. The current session sees BTC up 0.64% as buyers attempt to build momentum to push BTC above the 50-day SMA and reclaim $100,000. Buyers must reclaim and close above $100,000 to reverse the bearish trend. However, if sellers regain control, BTC could drop below $96,000 and retest the $92,000 level. A break below this level could see the price drop to $90,000. The RSI is currently at 45, while the MACD is bearish, indicating a downtrend. However, both indicators could flip if BTC reclaims $100,000. Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bitzo

You can visit the page to read the article.

Source: Bitzo

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

XRP Price Prediction for February 5

How great is chance to see bounce off from XRP soon? Bitzo

Analyst Predicts Altcoin Rally to December Highs by April at the Earliest

Altcoin Recovery Delayed Until April, Says Analyst Matthew Hyland According to crypto analyst Matthew Hyland , altcoins are unlikely to return to their December highs before April 2025 , citing mass liquidations and heightened market uncertainty . In a recent X (formerly Twitter) post , Hyland referenced U.S. President Donald Trump’s tariff threats , which have shaken global markets and triggered a crypto sell-off , particularly in altcoins. Key Factors Affecting Altcoin Recovery: Trade war fears leading to investor caution Increased market liquidations after economic uncertainty Historical patterns suggest a 2+ month recovery period Hyland advises investors to “keep expectations tempered” and anticipate a gradual market recovery similar to 2020 and 2022 market disruptions . Why Are Altcoins Struggling? 1. U.S.-China Trade War Fears Impacting Crypto Sentiment Trump’s tariff threats have led to mass liquidations . Investors are risk-averse , leading to declining altcoin prices . 2. Bitcoin Dominance Is Limiting Altcoin Growth BTC ETFs are attracting most institutional funds . Altcoin dominance remains weak , delaying potential rallies. 3. Market Cycles Suggest a Delayed Recovery In 2020 and 2022 , similar economic disruptions took over two months to stabilize. A full altcoin rally could take time , making April the earliest expected recovery period. Will Altcoins Rally by April? Bullish Scenario: If macroeconomic fears ease , altcoins may recover faster . Bitcoin price stabilization could lead to an altcoin rotation . Increased adoption of Layer 1 and DeFi projects could drive altcoin demand . Bearish Risks: Continued economic uncertainty may keep investors away from altcoins . If Bitcoin dominance remains high , capital may stay in BTC instead of alts . Further regulatory risks could slow down an altcoin resurgence . Conclusion Matthew Hyland’s forecast suggests that altcoins will struggle in the short term due to economic fears and market liquidations . While a recovery is expected, the timeline may extend until April 2025 or later. Investors should remain patient and manage expectations , as historical trends show that altcoin recoveries take time . Stay updated on altcoin market trends and crypto insights by following our latest analysis. Bitzo