The recent decision by the Arkansas Senate’s City, County and Local Affairs Committee to reject a bill aimed at banning crypto mining near military facilities highlights the ongoing tension between

CoinOtag

You can visit the page to read the article.

Source: CoinOtag

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

AAVE holds above THIS support – 30% rally may be in sight IF…

AAVE could soar by 30% to reach the $380 level if it holds itself above $285. CoinOtag

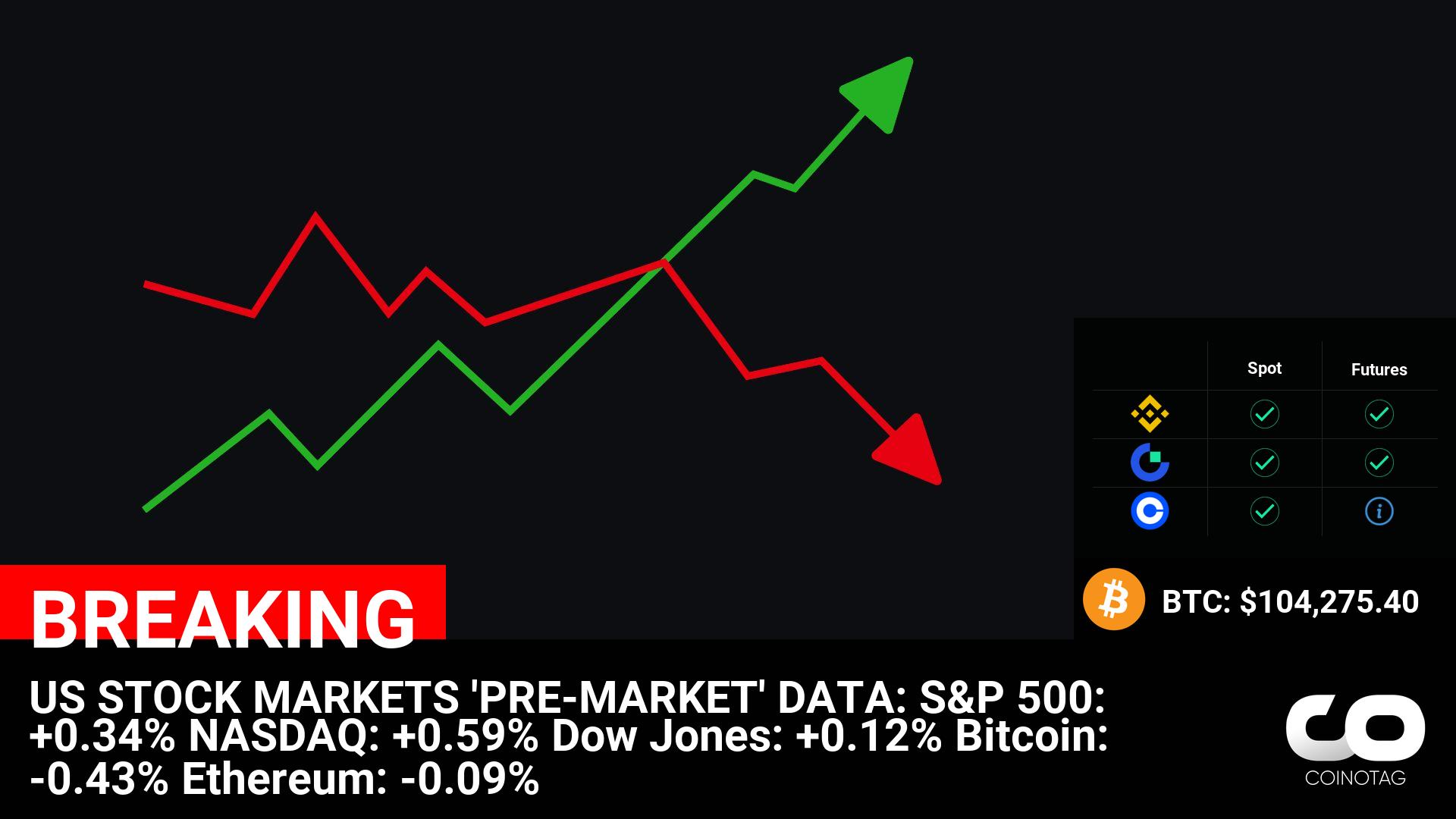

How Will Markets React as $10B in Crypto Options Expire Today?

Around 80,000 Bitcoin options contracts will expire on Friday, Jan. 30, and they have a notional value of roughly $8.36 billion. This week’s expiry event is a large one because it is the end of the month. However, crypto derivatives expiry events such as this rarely influence spot markets, which have remained relatively flat this week. Bitcoin Options Expiry This week’s batch of Bitcoin options contracts has a put/call ratio of 0.68, which means that there are more call (long) contracts expiring than puts (shorts). Moreover, open interest (OI), or the value or number of BTC options contracts yet to expire, is highest at the $120,000 strike price, which is $2.4 billion, according to Deribit. There is also around $1.65 billion in OI at the $110,000 strike price, as derivatives traders continue to speculate that BTC prices will rise from current levels. Earlier this week, crypto derivatives provider Greeks Live said the “longer-term outlook remains constructive with expectations of continued upward momentum.” Meanwhile, Deribit reported that Bitcoin’s brief drop below $100,000 this week caused changes in the derivatives market. Short-term traders were buying more put options than usual, but longer-term traders remained optimistic, favoring call options, it stated. Bitcoin OI by expiry. Source: Deribit Around 600,000 Ethereum contracts are also expiring in addition to today’s tranche of Bitcoin options. These have a notional value of $1.95 billion and a put/call ratio of 0.43. This brings Friday’s combined crypto options expiry notional value to around $10.3 billion. Crypto Market Outlook Total market capitalization has fallen just over 1% on the day to $3.68 trillion, where it was at the same time last week. Bitcoin reached $106,000 in an intraday high on Thursday but started to retreat during the Friday morning Asian trading session, falling to $104,300 at the time of writing. It has recovered from a Monday dip into the five-figure territory but failed to gain further momentum this week. Ethereum remains weak, having failed to reach $3,300 and trading at just over $3,200 at the time of writing. The altcoins were generally mixed with minor gains and losses on Friday morning. Stellar (XLM), Sui (SUI), and Litecoin (LTC) were doing a little better than the rest. Analysts have observed that February is usually much better for crypto price action than January, so things could be about to heat up. The post How Will Markets React as $10B in Crypto Options Expire Today? appeared first on CryptoPotato . CoinOtag