This holiday season, skip the doomscrolling and dive into some games worth your time. These picks will keep you entertained for hours.

Decrypt

You can visit the page to read the article.

Source: Decrypt

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

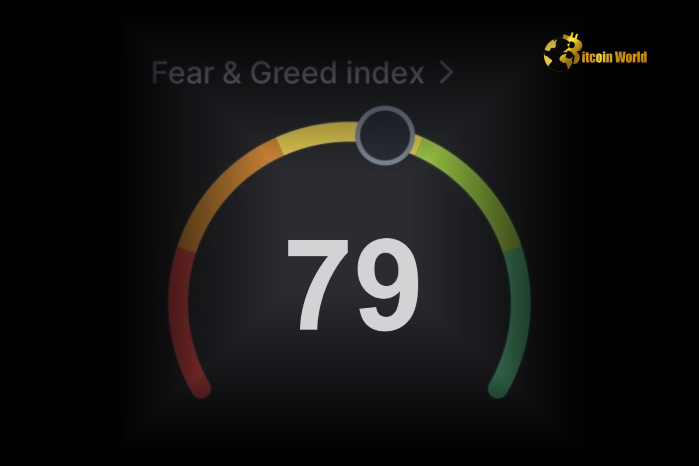

Bitcoin And Altcoins See Strong Recovery Heading Into Christmas

Bitcoin (BTC) and altcoins have made a notable rebound as Christmas Day approaches. BTC surged to as high as $99K, fueling optimism that the $100K mark could be within reach before the end of the year. Here’s a look at the current distribution of Bitcoin wallets by size: – Wallets with 0-0.1 BTC: 50.17 million – Wallets with 0.1-10 BTC: 4.31 million – Wallets with 10-1,000 BTC: 150,130 – Wallets with 1,000+ BTC: 2,050 Bitcoin and altcoins have recovered well heading into Christmas Day. BTC has rebounded as high as $99K with traders hoping for a $100K Xmas gift. Here are the number of BTC wallets by size: 0-0.1 BTC Wallets: 50.17M 0.1-10 BTC Wallets: 4.31M 10-1,000 BTC Wallets:… pic.twitter.com/D2I5Lntu09 — Santiment (@santimentfeed) December 25, 2024 The market’s bullish sentiment appears to be driven by accumulation, particularly within the larger wallet categories. As long as the number of wallets in these groups continues to rise and maintain their accumulation pattern throughout 2024, the chances of a sustained bull market increase. However, recent news from the Federal Open Market Committee (FOMC) had an immediate impact on the market. FOMC news hit the market hard—$BTC dipped to $92K, and alts took an even bigger hit. But here’s the twist: short-term holders (STH) under 3 months are up 3% in just a week. New money is stepping in. pic.twitter.com/CDHNdxptWA — Kyledoops (@kyledoops) December 25, 2024 Bitcoin briefly dipped to $92K, with altcoins experiencing an even more significant decline. Despite this, short-term holders (STH) with positions under 3 months have seen a 3% gain over the past week. FOMC news hit the market hard—$BTC dipped to $92K, and alts took an even bigger hit. But here’s the twist: short-term holders (STH) under 3 months are up 3% in just a week. New money is stepping in. pic.twitter.com/CDHNdxptWA — Kyledoops (@kyledoops) December 25, 2024 In the last 24 hours, the percentage of Bitcoin traders on Binance taking long positions decreased from 66.73% to 53.60%, reflecting a shift in market sentiment. The percentage of traders going long on #Bitcoin $BTC in Binance dropped from 66.73% to 53.60% in the past 24 hours. pic.twitter.com/blbdDH28MS — Ali (@ali_charts) December 25, 2024 As of December 24, Bitcoin ETF net flows showed a drop of 2,306 BTC, equating to approximately $226.3 million in outflows. Among these, Fidelity reported outflows of 1,573 BTC, valued at $154.29 million, leaving the firm with 203,194 BTC, currently worth about $19.94 billion. Despite market fluctuations, the Bitcoin ecosystem continues to show strong signs of growth and resilience. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news ! Image Source: studiograndouest/ 123RF // Image Effects by Colorcinch Decrypt

Russian Firms Embrace Cryptocurrency for International Trade Amid Sanctions

Russian Firms Embrace Cryptocurrency for International Trade Amid Sanctions Russian businesses are increasingly using cryptocurrencies, including Bitcoin, for international payments in response to Western sanctions. Recent changes in legislation have enabled this shift, offering companies an alternative to traditional payment systems that are hindered by geopolitical restrictions. Finance Minister Anton Siluanov confirmed the development, emphasizing its role in countering economic pressures. This strategic move underscores Russia’s efforts to adopt alternative financial mechanisms, with the potential to reshape global trade dynamics. Why Russian Firms Are Turning to Cryptocurrency Western sanctions have limited Russia’s access to traditional international banking systems, including the SWIFT network. This has forced businesses to explore decentralized financial systems like cryptocurrency, which are not subject to the same geopolitical constraints. Key reasons for the shift include: Circumventing Sanctions Cryptocurrencies operate independently of traditional banking systems, allowing Russian firms to engage in international trade without relying on sanctioned financial intermediaries. Increased Government Support Recent laws in Russia now allow the use of cryptocurrencies mined within the country for foreign trade transactions, providing a legal framework for adoption. Decentralized Nature of Crypto Cryptocurrencies like Bitcoin offer a decentralized payment mechanism, reducing reliance on centralized systems influenced by Western policies. Finance Minister’s Confirmation In an interview with the Russia 24 television channel, Finance Minister Anton Siluanov highlighted the growing role of cryptocurrency in Russia’s international trade strategy. “Cryptocurrencies mined in Russia are being used for foreign trade transactions, and we expect this approach to expand next year,” Siluanov stated. The minister’s comments reflect the government’s endorsement of crypto adoption as a key tool for mitigating economic isolation. Putin’s Critique of the Dollar’s Dominance Russian President Vladimir Putin has long criticized the politicization of the U.S. dollar in global trade. Earlier this month, he reiterated these concerns, stating that the U.S. is undermining the dollar’s status as the world’s reserve currency by using it as a tool for political leverage. Putin’s remarks highlight a growing trend among nations to seek alternatives to the dollar, with cryptocurrencies emerging as a viable option. Cryptocurrency Mining and Usage in Russia Russia is one of the world’s leading cryptocurrency mining hubs, thanks to its abundant energy resources and cold climate, which reduce mining costs. By leveraging domestically mined cryptocurrencies for international trade, Russia is effectively monetizing its mining capabilities while bypassing traditional financial barriers. Implications for Global Trade Russia’s adoption of cryptocurrency for international trade could have significant implications: Increased Crypto Adoption : Other sanctioned nations may follow Russia’s lead, accelerating global cryptocurrency adoption. Shift in Global Reserve Assets : The move away from the U.S. dollar could prompt broader diversification in global trade payments. Regulatory Challenges : Western nations may introduce new regulations to counteract the use of cryptocurrencies for sanction evasion. Potential Benefits and Risks for Russia Benefits : Resilience Against Sanctions : Cryptocurrencies provide an alternative payment system unaffected by Western financial controls. Economic Efficiency : Faster and cheaper cross-border transactions reduce trade friction. Financial Independence : Reduces reliance on traditional currencies and systems. Risks : Volatility : Cryptocurrencies are known for price fluctuations, which could impact trade values. Regulatory Backlash : Increased scrutiny from international regulators could create challenges. Security Concerns : Dependence on digital assets exposes trade transactions to potential cyber threats. Global Response to Russia’s Crypto Adoption The international community is closely monitoring Russia’s growing reliance on cryptocurrency. While some nations see it as a workaround to sanctions, others view it as a legitimate use of decentralized finance. Sanctioning Entities : Western nations may consider stricter regulations or targeted measures to curtail Russia’s use of cryptocurrencies. Neutral Parties : Countries not involved in sanctions may see this as an opportunity to strengthen trade ties with Russia through crypto-based systems. Crypto Advocates : Proponents of decentralized finance view this as a validation of cryptocurrency’s potential to enable financial inclusion. What This Means for the Crypto Market Russia’s shift toward cryptocurrency could have far-reaching effects on the global crypto market: Increased Demand for Bitcoin : As one of the most widely accepted cryptocurrencies, Bitcoin could see heightened demand. Mainstream Legitimacy : The use of crypto for international trade could boost its reputation as a viable alternative to traditional systems. Regulatory Evolution : Governments may need to update regulations to address the growing use of crypto in international trade. Conclusion Russia’s adoption of cryptocurrency for international trade marks a significant milestone in the global financial landscape. By leveraging Bitcoin and other digital assets, the country is navigating around Western sanctions and exploring a new frontier in decentralized trade systems. While this approach offers numerous benefits, it also raises questions about global trade dynamics, regulatory responses, and the future role of cryptocurrencies in the international economy. As Russia continues to expand its use of cryptocurrency in 2025, the world will be watching closely to understand the broader implications for finance, trade, and geopolitics. To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news , where we delve into the most promising ventures and their potential to disrupt traditional industries. Decrypt